Cloud migration is a huge decision that requires careful planning as banking and financial institutions have data security concerns.

The financial landscape is evolving rapidly, with digital transactions, mobile banking, and AI-driven services becoming the norm. Customers expect instant, seamless, and secure financial experiences—yet many banks and financial institutions struggle with outdated legacy systems that slow down innovation.

Legacy infrastructure limits scalability and also increases security risks and operational costs. The need for cloud migration is about survival in the digital era. However, making the shift requires more than just adopting new technology—it demands a well-planned migration strategy that ensures security, compliance, and operational efficiency.

If you’re wondering how to execute this transition seamlessly, check out our guide on cloud migration strategy for a step-by-step approach.

In this blog, we’ll explore why cloud migration is a must for fintech enterprises, the key benefits, and how People10 can help you make a smooth, secure, and strategic transition.

The Role of Cloud Migration in Financial Services: When is the Right Time to Migrate?

For banks and financial institutions, the question isn’t just about adopting the cloud—it’s about when and how to do it effectively. Traditional on-premises infrastructure offers full control over security and compliance, but it comes with high maintenance costs, limited scalability, and slow adoption of new technologies. On the other hand, cloud computing provides agility, cost efficiency, and built-in compliance tools, but it also requires a shift in security models and regulatory considerations.

With the finance cloud market projected to grow at 20.3% annually by 2030, many organizations see cloud adoption as a strategic advantage. But is it the right move for your institution? Below, we explore the key factors that influence this decision.

1. Managing data security and compliance

Financial institutions handle massive volumes of sensitive customer data, making security and regulatory compliance non-negotiable. But as global regulations become more complex, maintaining compliance with frameworks like Basel III, GDPR, and the Bank Secrecy Act (BSA) is becoming an uphill battle.

Here’s what compliance looks like across different financial sectors:

- Banking regulations: Strict adherence to Basel III, GDPR (for EU operations), and BSA for risk management, customer data protection, and anti-money laundering (AML).

- Securities and investments: Firms dealing with trading and brokerage must meet SEC, FINRA, and MiFID II guidelines to prevent fraud and ensure transparency.

- Payments and fintech compliance: Payment processors and digital lenders must comply with PCI DSS for secure transactions, while digital asset firms must follow AML/KYC regulations.

With on-premises infrastructure, institutions bear full responsibility for:

→ Implementing and maintaining encryption and data access policies

→ Conducting regular security audits

→ Ensuring real-time threat detection and response

→ Keeping up with ever-changing regulatory updates

This requires dedicated security teams, continuous monitoring, and significant investment in security tools.

Can Cloud Ease the Compliance Burden?

Leading cloud providers like AWS, Azure, and Google Cloud offer built-in security and compliance frameworks, simplifying adherence to regulatory standards. Instead of handling everything in-house, cloud adoption follows a shared responsibility model, where:

✔ Cloud providers manage infrastructure security, compliance updates, and global certifications (e.g., SOC 2, ISO 27001, PCI DSS, GDPR).

✔ Financial institutions configure security policies, control access, and manage application-level security.

The cloud also offers advanced security features like zero-trust verification, encryption, automated compliance monitoring, and real-time reporting, significantly reducing regulatory risks.

With audit-ready compliance tools and built-in security, the cloud removes a significant operational burden allowing financial institutions to focus on innovation rather than infrastructure maintenance.

2. Modernizing Legacy Systems: Overcoming the Limitations of Aging Infrastructure

Many financial institutions still rely on legacy systems built decades ago—functional but increasingly outdated. While these systems once set the industry standard, they now struggle to keep up with the demands of digital banking, real-time transactions, and seamless integrations.

The biggest challenges with legacy infrastructure?

→ Limited scalability due to physical hardware constraints

→ High maintenance costs for upgrades and security patches

→ Slow innovation cycles, making it harder to compete with digital-first banks

While on-premises modernization is an option, it comes with massive investments, longer timelines, and ongoing IT maintenance. Cloud-based modernization, on the other hand, enables agility, cost efficiency, and automatic updates, freeing financial institutions from the burden of managing infrastructure manually.

3. Adopting Innovative Technologies: Staying Ahead of Customer Expectations

Banking isn’t just about transactions anymore—it’s about seamless, intuitive, and personalized digital experiences. With Millennials and Gen Z leading the charge, today’s customers expect their banking experience to be as smooth as ordering a ride or streaming a movie.

So how do financial institutions keep up? By leveraging cloud-based innovations.

→ AI and Machine Learning: Automate fraud detection, risk analysis, and personalized financial recommendations.

→ Blockchain & Smart Contracts: Enhance security, transparency, and efficiency in financial transactions.

→ Real-Time Analytics: Enable instant decision-making for credit scoring, trading, and customer insights.

Unlike on-premises setups, which require manual scaling and expensive infrastructure upgrades, cloud platforms provide on-demand resources for AI training models, large-scale analytics, and real-time transaction processing.

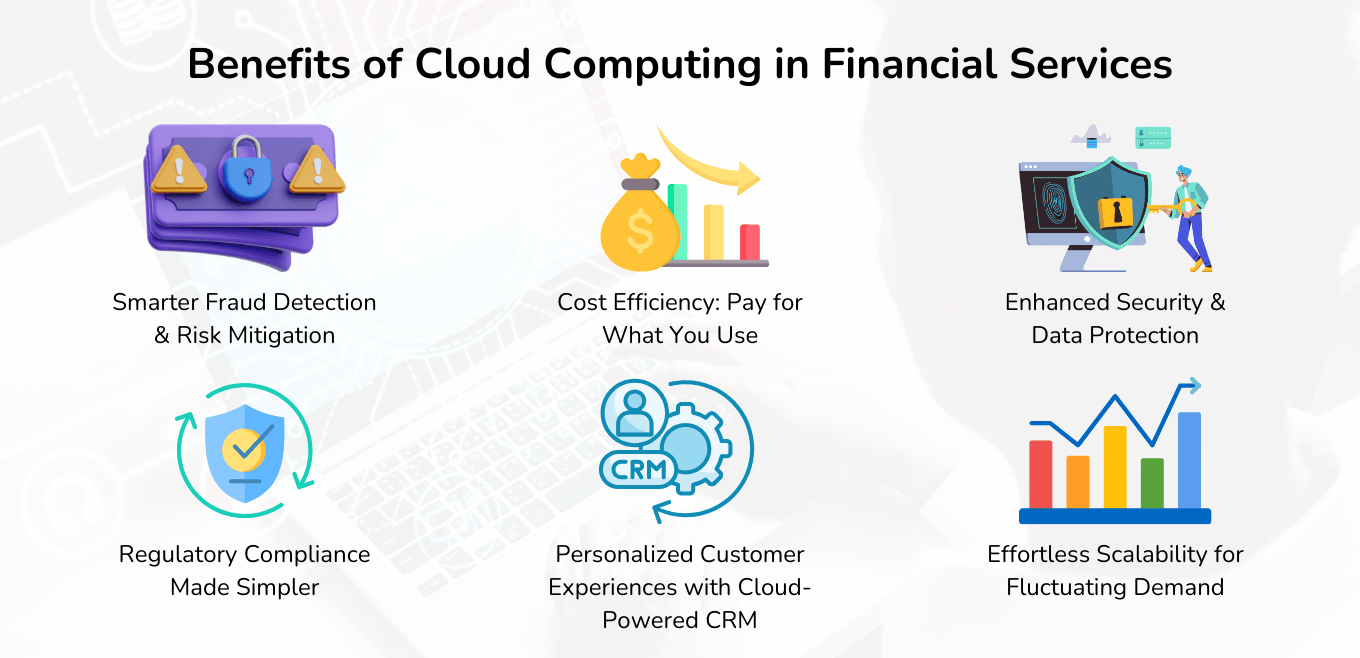

Benefits of Cloud Computing in Financial Services

Cloud computing is no longer just an option for fintech disruptors—it has become a necessity for financial institutions looking to stay competitive in a fast-evolving landscape. It unlocks new business models, enhances customer experiences, and boosts operational efficiency in ways that purely on-premises systems simply can’t match.

Let’s explore the key advantages of cloud adoption in the financial sector.

1. Smarter Fraud Detection & Risk Mitigation

Fraud in banking is constantly evolving—from identity theft and money laundering to speculative trading and financial scams. Traditional fraud detection systems rely on static rules, which can be slow to adapt.

Cloud-powered AI & machine learning can analyze vast amounts of real-time transactional data across multiple sources to detect anomalies, flag suspicious activities, and prevent fraud before it happens. By leveraging cloud-based analytics, financial institutions can respond faster and more accurately to emerging threats.

2. Cost Efficiency: Pay for What You Use

Building and maintaining on-premises infrastructure requires significant upfront investments, continuous upgrades, and dedicated IT staff. Cloud computing eliminates these burdens with a pay-as-you-go model, meaning you only pay for the resources you use.

→ Lower IT infrastructure costs – No need for expensive physical servers

→ Reduced maintenance overhead – Cloud providers handle system updates

→ Optimized spending – Scale resources up or down based on demand

For financial institutions looking to optimize costs without sacrificing performance, the cloud offers a far more sustainable and efficient model. Cloud computing is the key to cost-savings and enables better resource utilization.

3. Enhanced Security & Data Protection

Financial institutions handle highly sensitive customer data, making security a top priority. While on-premises systems require in-house teams to manage security protocols, cloud providers offer built-in, enterprise-grade security with multiple layers of protection.

→ End-to-end encryption for data at rest and in transit

→ Real-time threat detection to prevent cyberattacks

→ Automated security patches to stay ahead of vulnerabilities

Additionally, cloud platforms operate under strict compliance certifications (e.g., SOC 2, PCI DSS, GDPR) and provide audit-ready environments, making it easier for financial institutions to meet regulatory requirements.

4. Regulatory Compliance Made Simpler

Navigating complex financial regulations is a challenge, but cloud providers make it easier by offering pre-configured compliance tools and automated reporting capabilities.

→ Built-in compliance with frameworks like Basel III, GDPR, SEC, and PCI DSS

→ Automated monitoring to flag non-compliance risks in real time

→ Centralized audit logs for quick, accurate reporting

With compliance embedded directly into cloud platforms, banks and financial institutions can reduce regulatory risk and stay ahead of evolving industry standards.

5. Personalized Customer Experiences with Cloud-Powered CRM

Customers today expect hyper-personalized banking experiences—73% of customers expect companies to understand their needs and preferences.

Cloud-based Customer Relationship Management (CRM) solutions help financial institutions:

→ Centralize customer data for better insights

→ Automate personalized offerings based on behavior and history

→ Enable seamless omnichannel experiences (mobile, web, chat, in-person)

By leveraging cloud-powered CRM, banks can deliver proactive, tailored services that enhance customer loyalty and satisfaction.

6. Effortless Scalability for Fluctuating Demand

Unlike traditional infrastructure, which requires purchasing excess capacity to handle peak loads, cloud computing allows financial institutions to scale resources dynamically. This elastic scalability ensures financial institutions remain agile, responsive, and cost-efficient in an ever-changing market.

Conclusion

Cloud migration is the key for FinTech and Banking firms seeking innovation and productivity amidst restricted budgets. The shift to cloud computing leads to fewer manual processes, improved accuracy, and informed decisions. With the above benefits, every financial institution needs to make this transformation.

People10 is designed to help financial institutions achieve these objectives. It is a comprehensive, cloud-based communication system that enables seamless interactions. It integrates with popular applications firms already use and features the most advanced security protocols.

Need Help Innovating Faster With Cloud Technology?

We are technology experts & subject-matter thought leaders who deliver unparalleled value to our client partners.

Author

Shrutha Sekharaiah brings over 13 years of experience in delivering innovative, scalable solutions. His broad expertise in technology and focus on collaboration and mentorship drive the creation of robust systems enhancing efficiency and performance.