Is your FinTech software ready for the future?

According to Statista, by 2028, 4.8 billion users will transact digitally. With this surge in demand, coupled with evolving regulations and heightened security risks, developing a scalable, high-performance FinTech application is no longer a choice, it’s a necessity.

However, the real challenge lies in ensuring your software can scale seamlessly while maintaining robust security.

This is where dedicated software teams play a crucial role. Whether you’re a bank expanding digital services, a FinTech startup driving innovation, or a payment provider processing millions of transactions, a specialized team ensures:

- Consistent performance under increasing user loads

- Faster time-to-market with agile development approaches

- A future-proof tech stack that adapts to regulatory and industry changes

Let’s explore how dedicated teams can drive scalability, security, and long-term success in financial applications.

Addressing Scalability Challenges in Fintech Applications

Scalability in FinTech isn’t just about handling higher transaction volumes, it’s about delivering seamless, secure, and high-performance financial solutions at any scale. Whether processing thousands of transactions per second or expanding into new markets, your application must scale efficiently without compromising security, speed, or regulatory compliance.

This is where dedicated software teams make a difference. They don’t just build software, they design architectures that evolve with your business. Here’s how they address key scalability challenges in FinTech:

1. Legacy Systems & Performance Bottlenecks

Many financial institutions still rely on outdated infrastructure, leading to slow processing times and service disruptions during peak hours. Dedicated software teams modernize these systems by:

- Implementing microservices architectures to ensure smooth scalability.

- Migrating to cloud-native solutions for flexibility and cost-efficiency.

- Using high-performance databases to optimize real-time transaction processing

2. Security & Compliance at Scale

As fintech platforms grow, so do cybersecurity threats. Scaling without a strong security foundation can expose sensitive financial data. A dedicated team ensures:

- End-to-end encryption and robust identity management.

- Continuous compliance monitoring for regulations like GDPR, and PCI-DSS.

- Automated security testing to detect vulnerabilities before they impact users.

3. Seamless Feature Deployment & Innovation

Rolling out new features without downtime is a major challenge for fintech applications. Dedicated DevOps teams address this by:

- Enabling CI/CD implementation for faster, risk-free releases.

- Utilizing containerization (Docker, Kubernetes) for consistent performance.

- Implementing A/B testing and feature toggles to refine new offerings with minimal disruption.

4. Handling High Transaction Volumes

Scaling a financial application means being ready for millions of simultaneous transactions. dedicated software teams ensure performance with:

- Load balancing and auto-scaling to distribute traffic efficiently.

- Event-driven architectures that process transactions in real-time.

- Optimized data storage and caching for faster access and reduced latency.

5. Elevating Customer Experience

A fintech app must remain fast and responsive, no matter how many users it serves. Dedicated software teams:

- Design intuitive and scalable UI/UX to support global user bases.

- Implement AI-driven chatbots and automation to handle support at scale.

- Optimize backend performance for instant payment processing and account management.

Scaling Financial Applications with a Dedicated Team

A leading financial services provider struggled with unpredictable transaction spikes, downtime risks, and compliance challenges due to legacy infrastructure.

Our Approach: A dedicated software team from People10 implemented Kubernetes as a Service (KaaS) to enable auto-scaling, seamless deployments, and enhanced security.

3x scalability | 99.99% uptime | 25% cost savings

Here’s the complete case study for you to read how our experts transformed their operations.

Why Hiring a Dedicated Software Team is the Key to Scalable Fintech Applications

Scaling a fintech application requires a highly skilled and adaptable team that can build, optimize, and expand the system without disruptions. A dedicated software development team brings the right expertise, speed, and flexibility to ensure seamless scalability. Here’s how:

1. Expertise That Grows With Your Needs

A fintech platform must evolve to handle increasing transaction volumes, integrate with emerging technologies, and meet ever-changing regulatory requirements. A dedicated team:

- Comes with specialized fintech knowledge, reducing onboarding time.

- Stays ahead of compliance and security updates, ensuring adherence to industry standards.

- Has experience scaling cloud-native architectures, enabling elastic expansion.

2. Accelerated Time-to-Market Without Compromising Quality

Scaling requires both speed and stability. Dedicated software teams operate with agile technologies to ensure rapid feature releases while maintaining system reliability. With a dedicated team, fintech companies can:

- Develop, test, and deploy new features in shorter sprint cycles.

- Minimize downtime with automated testing and CI/CD pipelines.

- Manage increase in user demand without performance issues.

3. Seamless Scalability Without Overloading Internal Teams

As the application’s demand increases, internal teams can become overwhelmed with scalability challenges such as optimizing database performance, handling API integrations, and ensuring 24/7 system availability. A dedicated software development team:

- Takes ownership of performance optimization and load balancing.

- Offloads routine tasks like monitoring, maintenance, and debugging.

- Works in sync with your in-house team, ensuring seamless cross-functional collaboration.

4. Cost-Efficient and Flexible Resource Allocation

Instead of investing in recruiting in-house teams that may not always be fully utilized, fintech companies benefit from on-demand dedicated software teams that scale as needed. This model ensures:

- Flexible engagement options (full-time, part-time, or project-based teams).

- Optimized costs by hiring specialized talent only when required.

- Efficient workload distribution, ensuring high-priority tasks get immediate attention.

5. Security-first Approach for Long-term Growth

Scaling fintech applications introduces increased security risks, from cyber threats to compliance violations. Dedicated software teams bring a security-first approach, integrating robust protection at every stage:

- Secure coding practices prevent vulnerabilities before they become threats.

- Proactive risk assessments mitigate compliance gaps.

- Real-time monitoring and incident response ensure system integrity 24/7.

Proven Success: How Fintech Leaders Scale with Remote Teams

Leading FinTech companies have embraced dedicated remote teams to drive innovation, enhance scalability, and accelerate time-to-market. By leveraging remote talent, these companies overcome operational challenges, optimize costs, and build resilient, high-performing teams.

1. Affirm – Building a High-Performance Remote Culture

Affirm, a leading FinTech company, transitioned to a remote-first model during the COVID-19 pandemic and has continued this approach due to its significant benefits, including:

- Access to a broader talent pool without geographical constraints

- Increased productivity through flexible work environments

- Cost-efficient scaling while maintaining high performance

To strengthen its company culture, Affirm emphasizes a “high-performance culture” by implementing structured collaboration frameworks. The company also organizes quarterly in-person gatherings in co-working spaces, fostering team engagement and deeper collaboration among employees.

By adopting a remote-first strategy, Affirm has successfully scaled its operations while maintaining agility, innovation, and employee satisfaction.

2. Broadridge Financial – Expanding Remote Tech Teams in India

Broadridge Financial, a U.S.-based FinTech firm, is strategically expanding its technology workforce in India by 26% over the next three years. This initiative aims to:

- Modernize legacy systems to enhance efficiency and scalability

- Strengthen product innovation with advanced technology solutions

- Leverage India’s deep tech talent pool to scale development efforts

As part of this expansion, Broadridge is hiring a significant number of software engineers to bolster its remote development capabilities, ensuring seamless product evolution and market adaptability. This move reflects a global talent strategy that enables the company to drive innovation while optimizing costs and accelerating time-to-market.

By investing in remote tech teams in India, Broadridge demonstrates how FinTech firms can successfully scale operations, enhance agility, and stay competitive in a rapidly evolving financial landscape.

3. FinExpert – Developing a Fintech Product with a Dedicated Remote Team

FinExpert leveraged Mobilunity’s Dedicated Development Team model to transform their newly built FinTech product into a scalable, high-performance solution. By hiring a Ukrainian-based CTO and a dedicated remote team, FinExpert successfully:

- Designed a robust product architecture to ensure long-term scalability

- Optimized cloud infrastructure for seamless performance and cost efficiency

- Implemented secure and efficient payment processing to enhance user experience

By taking full ownership of the product’s architecture and scalability, the remote team played a crucial role in driving FinExpert’s growth and innovation.

From modernizing infrastructure to ensuring seamless financial transactions, these success stories demonstrate how dedicated remote teams empower FinTech companies to scale efficiently while maintaining agility, security, and compliance.

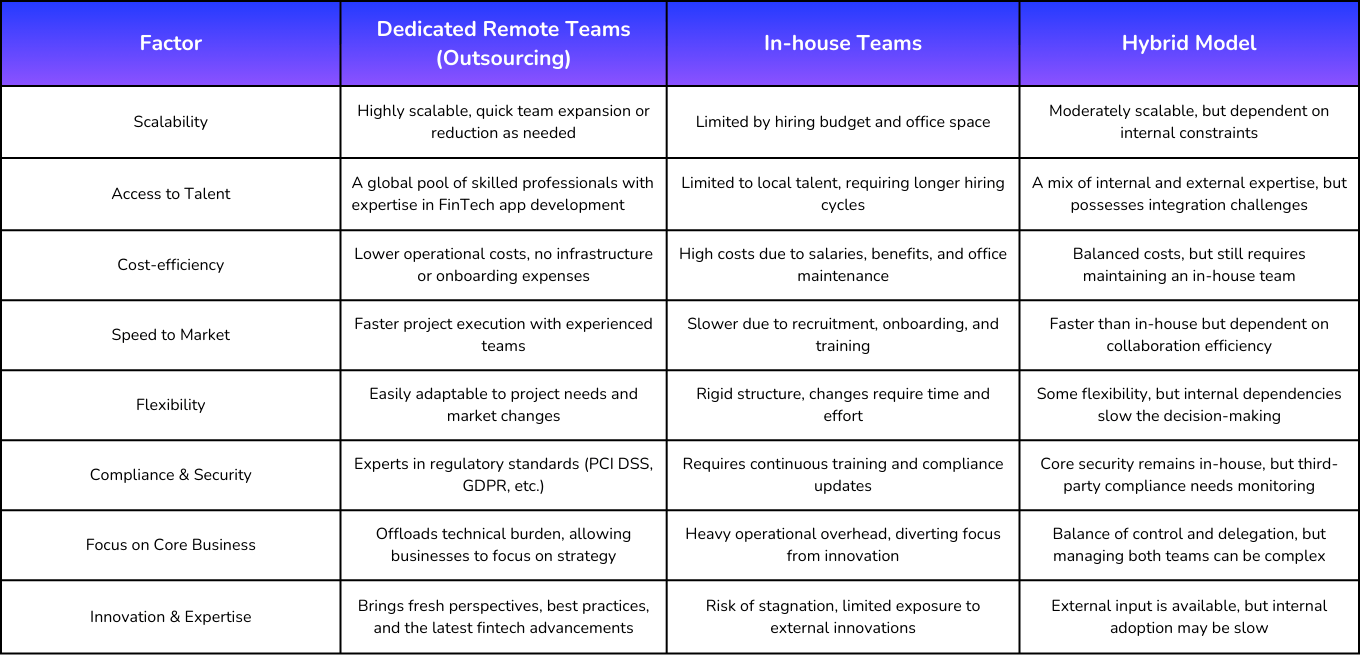

Choosing the Right Team Model: What Works Best for Scalability?

Conclusion

Scalability is no longer a choice but a necessity for fintech companies aiming to stay competitive. As user demands grow and technology evolves, having the right expertise to build flexible, high-performing applications is critical. Choosing the right development model can be the difference between outpacing competitors or struggling with inefficiencies and bottlenecks.

Dedicated remote teams offer the agility, specialized expertise, and cost-effectiveness needed to scale FinTech solutions efficiently. By leveraging global talent and cutting-edge technology, companies can overcome complex challenges, ensure seamless scalability, and accelerate growth in the digital financial ecosystem.

Is Your FinTech Growth Blocked?

Overcome performance bottlenecks and handle growing user demands with our dedicated teams. Let’s build future-ready fintech solutions together.

Author

A seasoned tech leader with 20+ years of experience, Nisha drives global business development and client relations at People10.